Corporate Governance

We work at the interface of directors’ duties and financial services, guiding how best practice and compliance reinforces both these duties and obligations.

Corporate governance is fundamental to a company’s long-term sustainable success. There are ever increasing pressures on companies and their directors to act in a socially responsible and transparent manner. This brings opportunities for companies to differentiate themselves and to develop, implement, and communicate their purposes, culture, values and strategy. But, if not, the threats are compliance failures, liability, brand and reputation damage, and even personal liability. We provide constructive and practical guidance to companies and their boards to maximise these opportunities, anticipate trends in corporate governance and meet the growing expectations of investors and other stakeholders.

CORPORATE SUSTAINABILITY

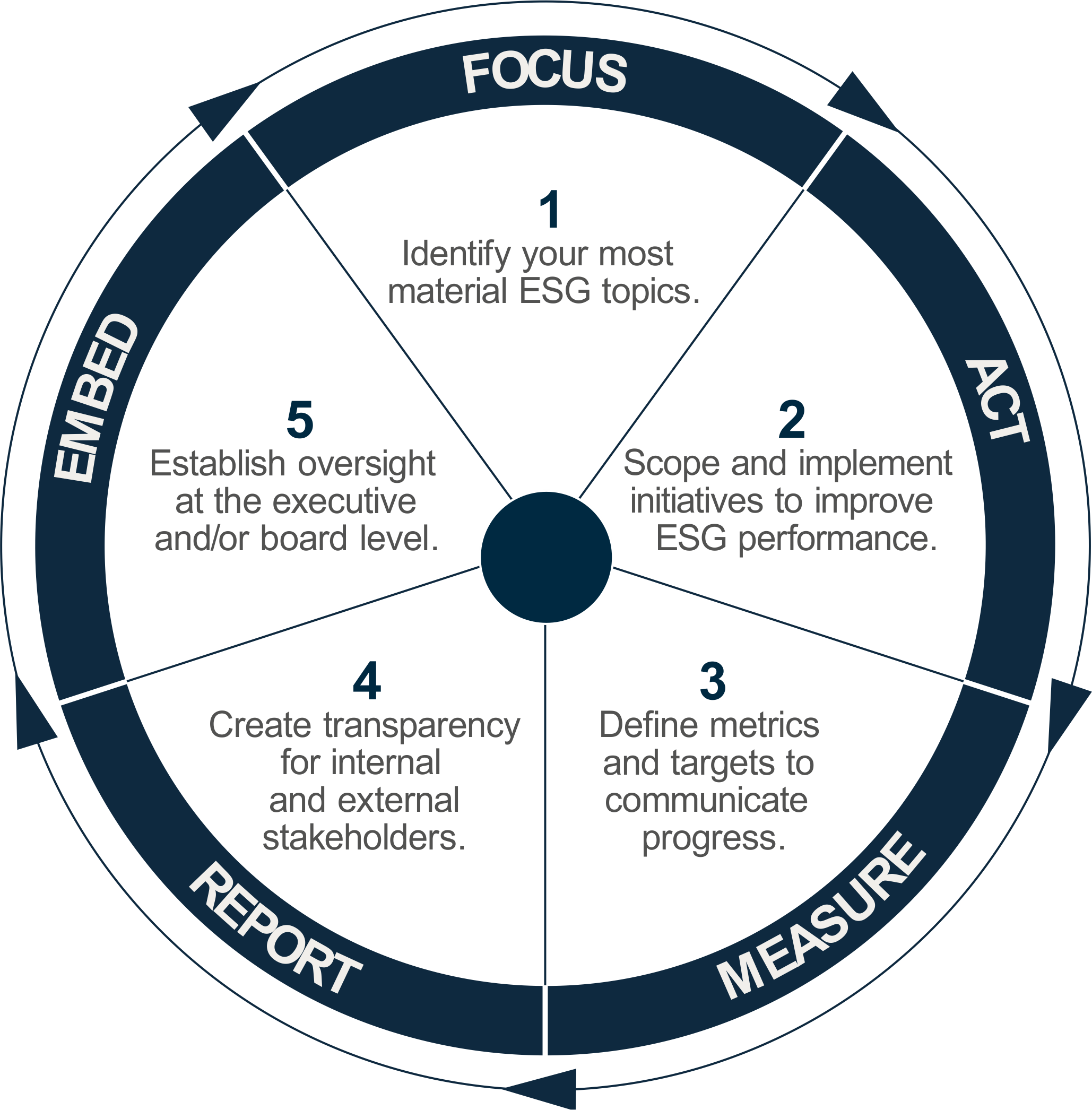

OUR APPROACH

We believe that to integrate sustainability into our own operations, we need to articulate a clear vision for best practice, starting with understanding our material issues, and ending with accountability at the highest levels of our organization. This vision enables the range of internal partners who are responsible for our most material ESG issues — supporting & developing talent, DEI, philanthropy, climate change, governance, compliance & ethics, cybersecurity and business continuity — to work independently while responding to the growing need for ESG disclosure and performance.

Supporting & Developing Talent

We recruit, support, develop and reward outstanding people because they are at the heart of our success. Our people and our culture are the most critical strategic drivers of our success. Our core business activities require significant skills and expertise. To attract and retain a high-performance team, we seek to foster a welcoming and inclusive work environment with opportunities for growth and development. Our unique culture, which centers upon values of collaboration, responsibility, entrepreneurialism, self-awareness and trustworthiness, makes us a preferred place for top talent at all levels — a place where outstanding people can build a long-term career within the alternative asset management industry.

2021 HIGHLIGHTS

In 2021, we were recognized as a Great Place to Work by Great Place to Work U.S., based on employee feedback across a range of dimensions. We invested over $850,000 in training and development and are formalizing a talent development function in 2021

"We really like working with them - they are timely, efficient about getting answers and provide a lot of perspective".Chambers & Partners,

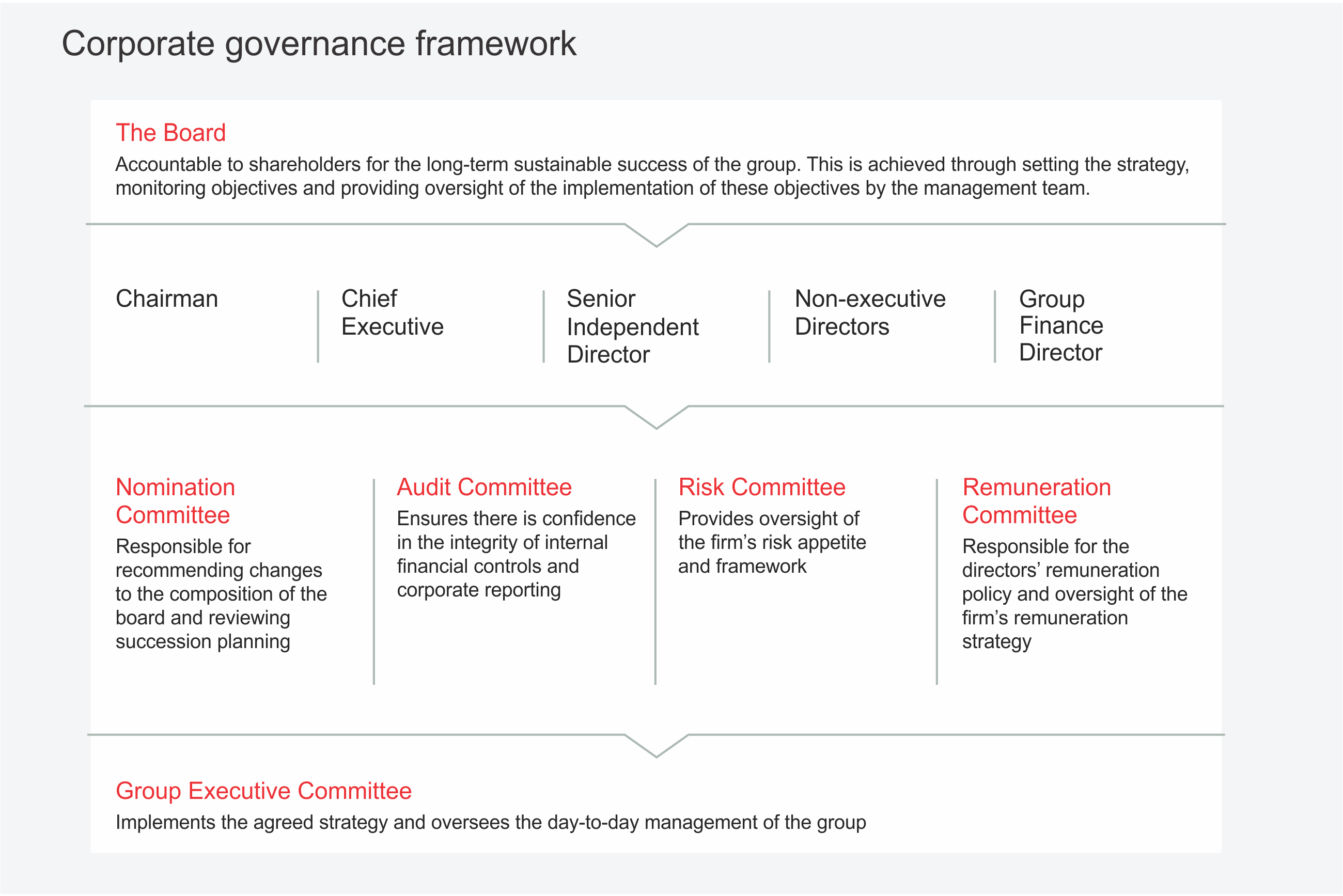

And, we work at the interface of directors’ duties and financial services and other regulatory obligations, guiding how best practice and compliance reinforces both these duties and obligations. Our international team supports companies on all aspects of corporate governance, legal risk and compliance advice. We provide clear and constructive advice and ensure director and management duties are observed.

We advise on:

- Directors’ duties

- D&O insurance/directors’ indemnities

- Corporate governance

- Board evaluations

- Executive remuneration

- Share incentives/schemes

- Risk management and internal systems and controls

- Shareholder and stakeholder engagement

We partner with non-lawyers to integrate practical and legal guidance to help protect your directors. We use technology to communicate, update and analyse corporate governance issues.

Respect for Workers

Teams with higher employee engagement enjoy lower costs, a safer workforce, and generally outperform their peers. Since the inception of Finxerium ESG Program, the firm has recognized the links between employee engagement, safety, and reporting company performance

Workforce Data Overview

4000+

reporting company employees1,300+

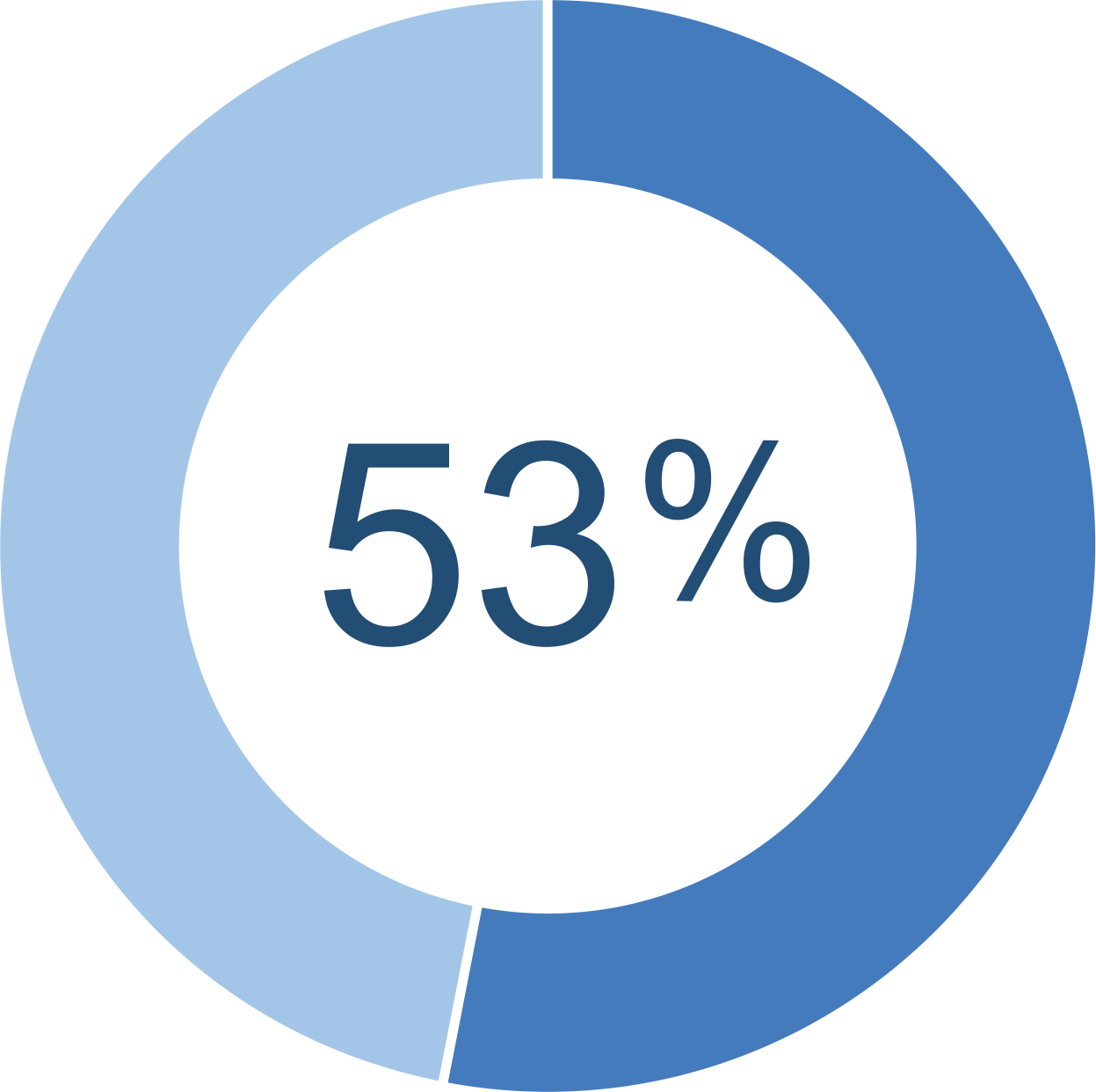

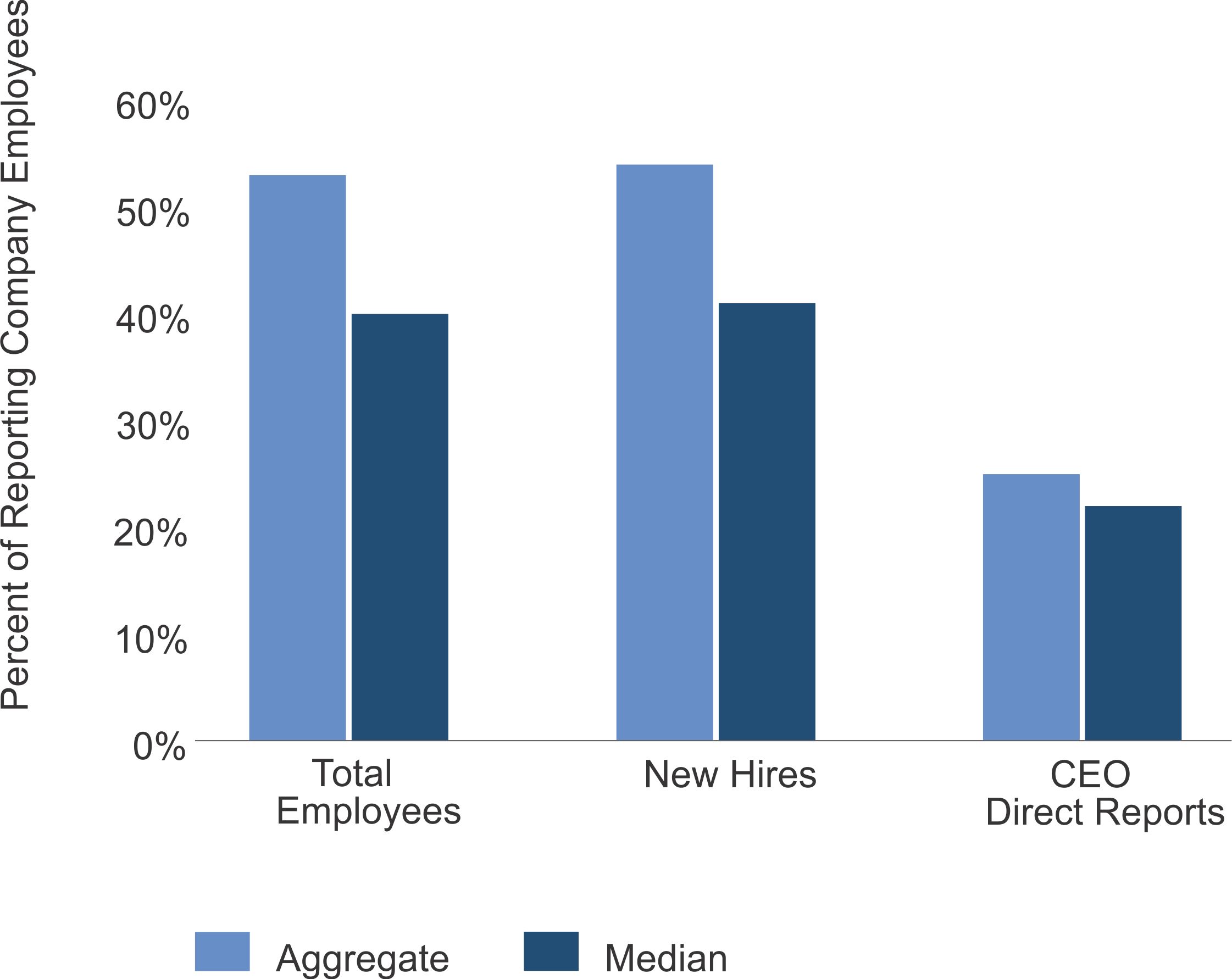

new hires by reporting companies in 2019Percent of Reporting Company Employees Who Identify as Female

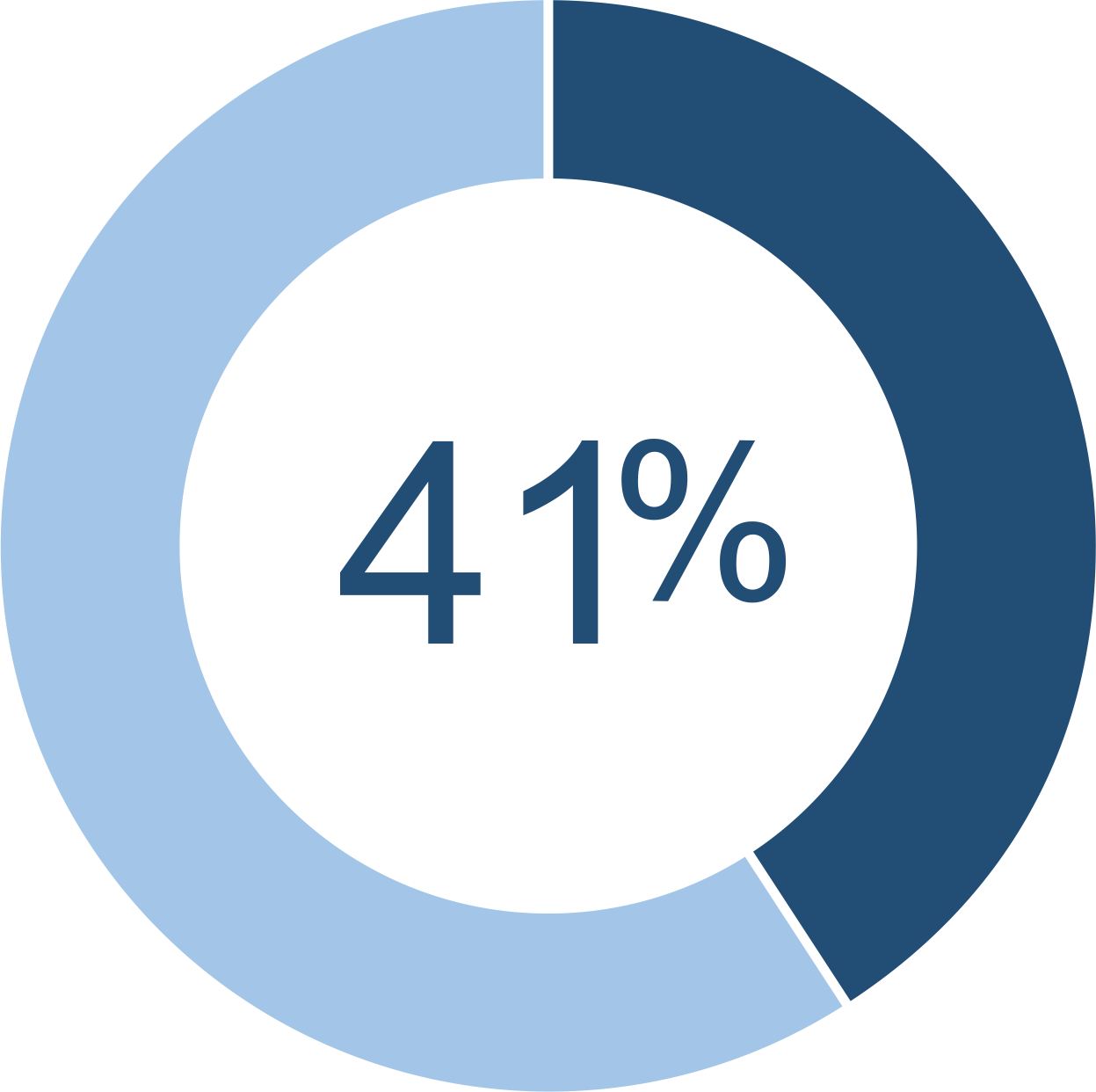

Percent of 2019 New Hires by Reporting Companies Who Identify as Female

Employee Engagement, Workforce Safety, and Workforce Diversity

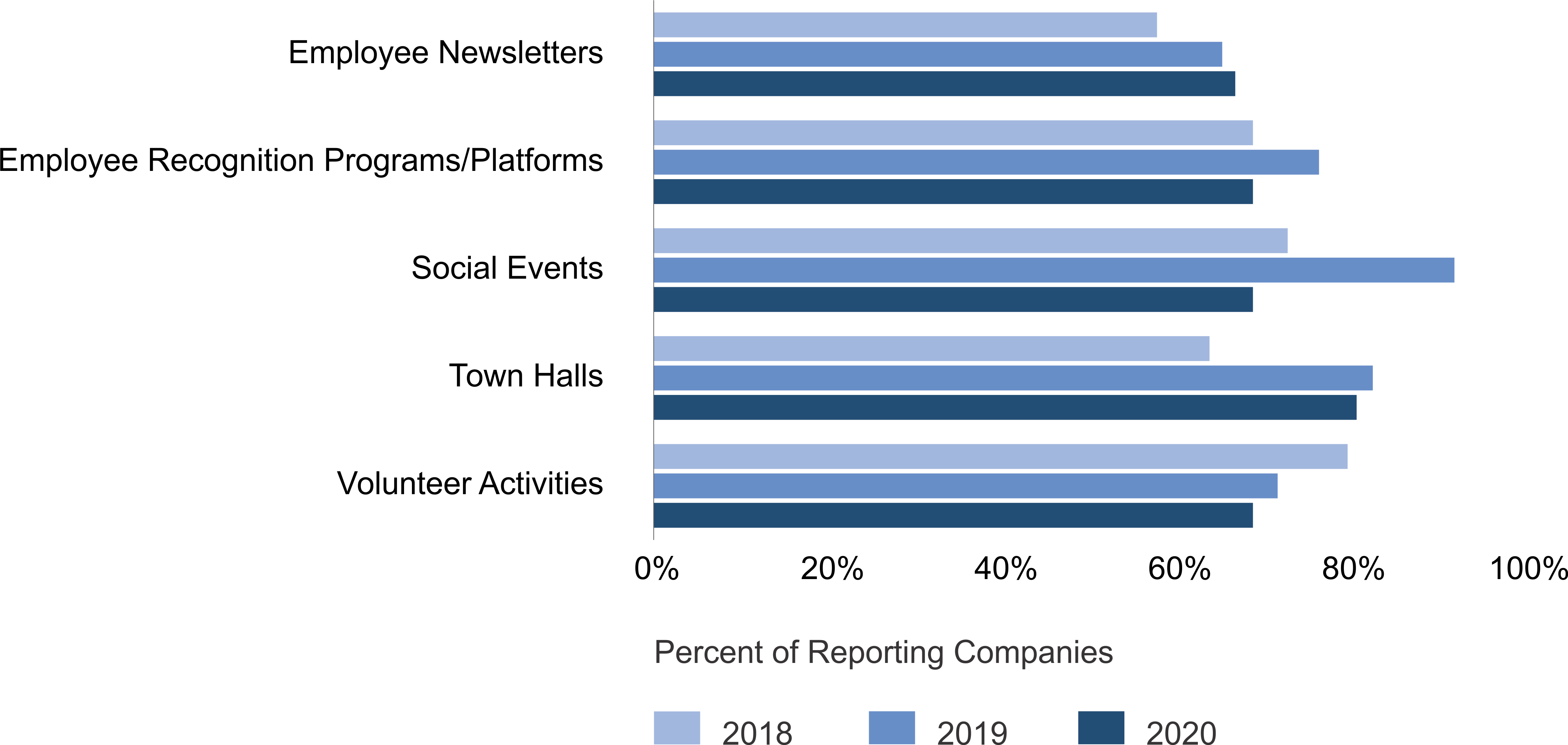

Employee Engagement

Percent of Reporting Companies with

Employee Engagement Initiatives

Percent of Reporting

Company Employees Who

Identify as Female

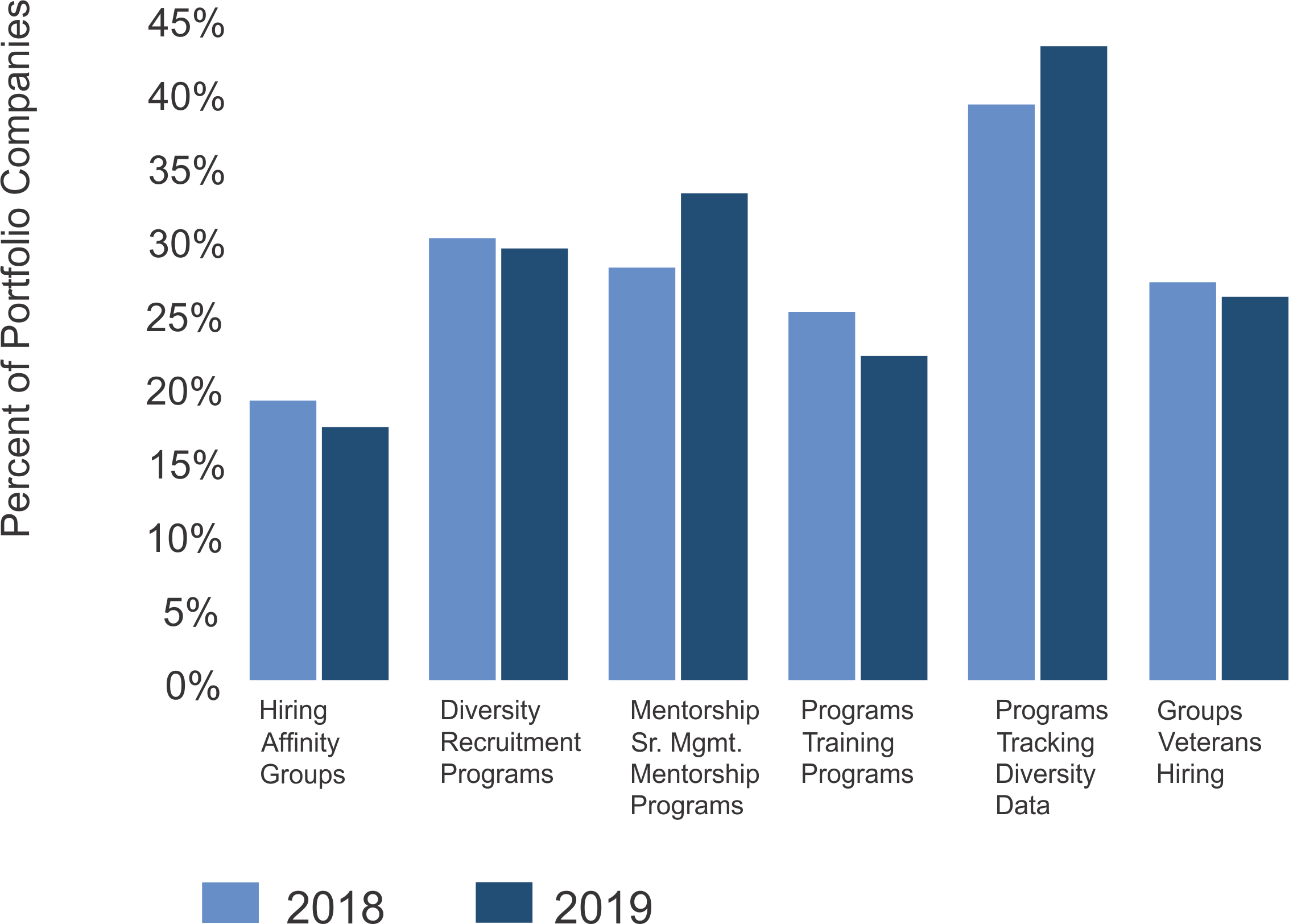

Workforce Diversity

Reporting Company Diversity Initiatives

Gender Diversity of Reporting Company Employees

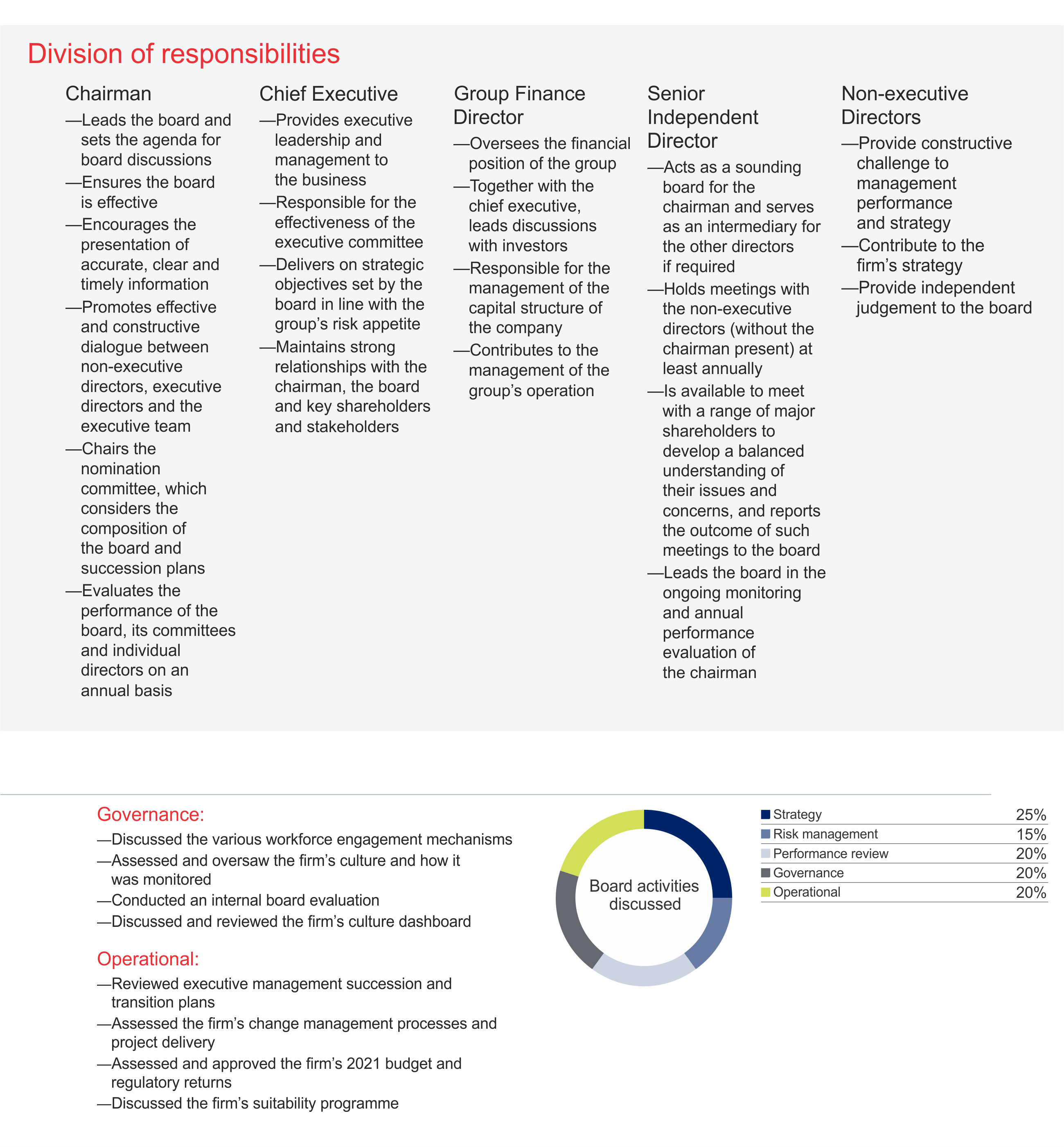

Governance at a glance

Board Activities

Strategy

- Held a number of additional board meetings in response to COVID-19.

- Set up a Crisis Management Team to address the need of the firm.

- Monitored the firm’s new strategy.

- Held strategy day with group executive team.

- Conducted an external review of market trends and emerging competitors.

- Focused on delivery of organic growth initiatives.

Risk Management

- Discussed and considered the impact of COVID-19 on our stakeholders.

- Approve the firm’s risk framework and appetite.

- Monitored the firm’s principal risks and compliance programme.

- Received detailed reports on significant regulatory risks and management’s mitigating actions.

- Reviewed the implications of Brexit for the organisation.

- Oversight and review of the firm’s whistleblowing report.

- Discussed and considered the firm’s business continuity plans.

Performance review

- Discussed various financial and market scenarios in the COVID-19 climate.

- Oversaw financial performance against the plan and market expectations.

- Reviewed and approved capital requirements of the firm.

- Approved interim and full-year financial statements, interim dividend and recommended final dividend .

Finxerium risk culture

A sound risk culture has been integral to Finxerium risk management framework since inception. Primary responsibility for risk management in Finxerium, including risk culture, is at the business level. The Board, assisted by the BRiC, is responsible for:

- reviewing, endorsing and monitoring Finxerium approach to risk culture and conduct risk

- forming a view on Finxerium risk culture and the extent to which it supports the ability of Finxerium to operate consistently within its risk appetite.

Finxerium approach to maintaining an appropriate risk culture is based on the following three components:

Setting behavioural expectations

Senior management, with oversight from the Board, sets behavioural expectations. The way we fulfil Finxerium purpose is defined by our principles of What We Stand For: Opportunity, Accountability and Integrity. Staff are made aware that these principles must form the basis of all behaviours and actions. These behavioural expectations are specified in the Board approved Code of Conduct, which is actively promoted by management and cascaded through the organisation.

Leading and executing

Management implements behavioural expectations through:

- leadership actions and communication

- organisational governance.

- incentives and consequence management.

- organisational and individual capability.

Corporate Governance Statement

Finxerium has an investor relations program to facilitate effective two‑way communication with investors and analysts and to provide a greater understanding of Finxerium’s business, performance, governance and financial prospects. Finxerium engages with institutional investors, private investors, sell‑side analysts and buy‑side analysts throughout the year via scheduled and ad hoc interactions

Board diversity and tenure

The Board of Finxerium believes that its membership should comprise Directors with an appropriate mix and diversity of skills, professional experience, tenure, gender and personal background. The general expectation is that NEDs will serve three 3‑year terms from first election by shareholders. NEDs may serve for longer than three 3‑year terms if the Board considers it to be of significant benefit to Finxerium.